Welcome To Fairview Inn & Suites

Fairview Inn & Suites, One of the Best Hotels in Healdsburg, CA

Escape the hustle and bustle of everyday life and discover the wonders of Sonoma County with a restful stay at Fairview Inn & Suites in Healdsburg, CA. This destination is renowned for its stunning vineyards, historic square, quaint cafés, and boutiques. Come for the wine, and stay for the good vibes and quaint surroundings. Adventures await when you book a stay at our Healdsburg hotel.

Fairview Inn & Suites, An Affordable Hotel in Healdsburg, CA, Offering Modern Guestrooms and Top-notch Amenities

Whether you are looking for a relaxing getaway or to enjoy the many different activities in wine country, the Fairview Inn & Suites is your best lodging choice in Sonoma Valley. Our warm and welcoming guest rooms feature modern amenities, including free high-speed WiFi, coffee-making facilities, and air-conditioning, plus private bathrooms with plush towels and complimentary amenities. Further, our property offers a refreshing outdoor pool, free parking, and a friendly front desk staff that is available 24 hours daily.

Fairview Inn & Suites, A Top Hotel in Healdsburg, CA, Nearby Top Vineyards and Attractions

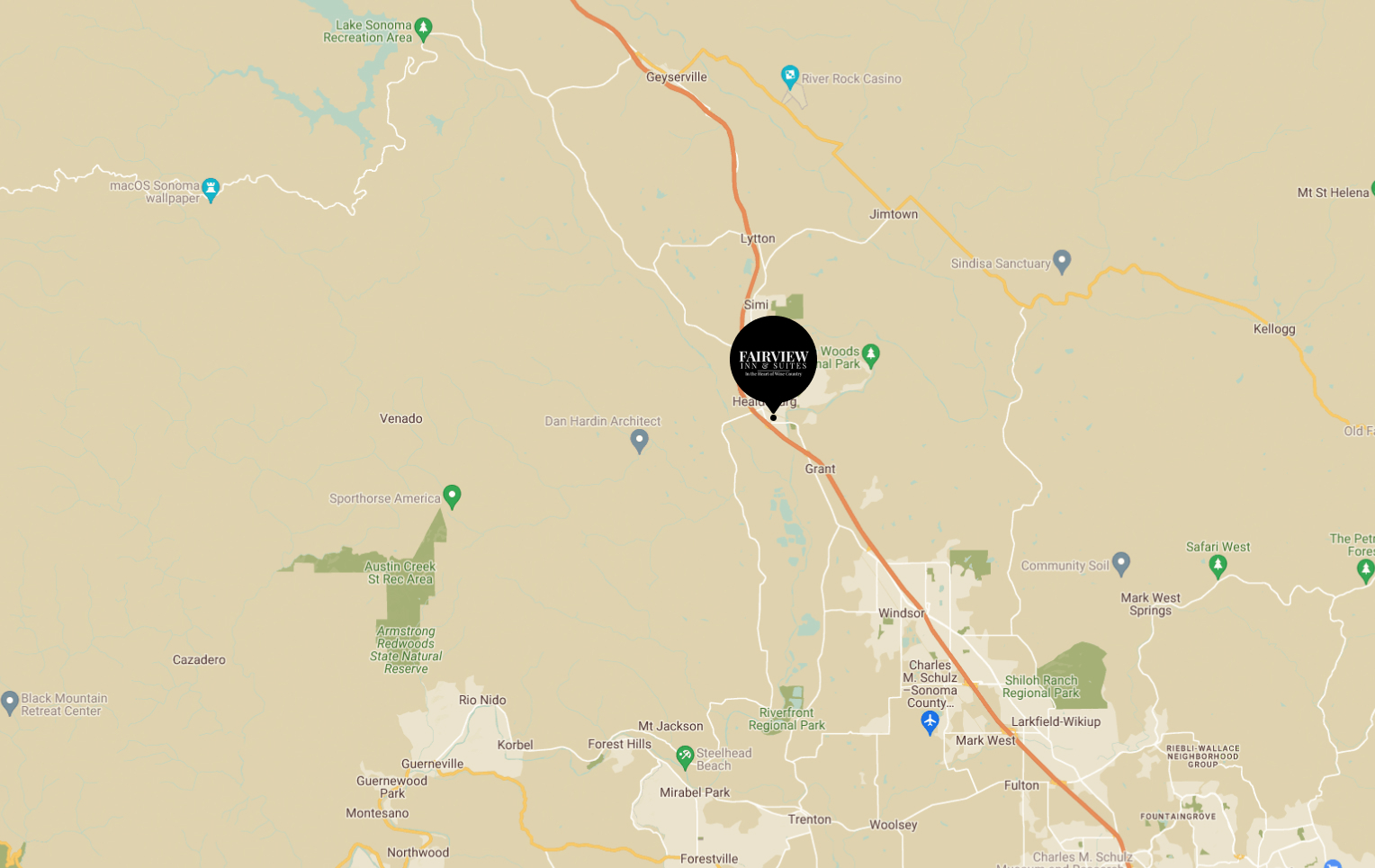

Our hotel in Healdsburg, CA, is conveniently located in the heart of the Sonoma Wine Country in Healdsburg, California, just 60 miles north of San Francisco on Hwy 101. There are also many restaurants within a two-mile radius, with some within walking distance. Some of the top attractions nearby include Healdsburg Plaza, Healdsburg Museum & Historical Society, Chalk Hill Estate Vineyards & Winery, Silver Oak Winery, and the Russian River Rose Company.

Attractions

HEALDSBURG, CALIFORNIA

Located on the property, Jeffrey’s Hillside Cafe, offers delicious, fresh, local produce, dairy and meat from all around the Bay Area.